Across manufacturing and construction, companies are stepping back from maintaining their own overseas sourcing teams. The global supply chain has become too specialized, too regulated, and too complex to manage from an office half a world away. Instead, many Canadian industries, from retail to heavy manufacturing, now appoint trading importers to manage their niche, technically driven procurement needs. These partners hold long-term relationships with certified factories, negotiate freight and tariffs in advance, and handle documentation and logistics as a single managed service.

That same transformation has reached the fire-sprinkler sector. Distributors, wholesalers, and contractors who once relied solely on U.S. inventory or tried to buy directly from mills are discovering that the real growth path lies in partnering with specialized trading importers. Because sourcing certified fire pipe isn’t about finding the lowest quote. It’s about securing the right pipe, at the right time, with the right documentation.

—————————————————————————————————————————————————————————————————-

1. An industry trend led by proven global players

The model is not new. It’s already proven in Canada’s steel and pipe industry.

Mitsui & Co. (Canada) Ltd., a global trading group active in tubular and structural steel, describes its role clearly:

“Our close ties with steel mills in Japan, China, Korea, Taiwan and Malaysia enable us to provide our customers with the right steel to meet their requirements in a timely manner.” This statement captures what trading importers bring to the table, direct mill relationships, production access, and delivery reliability that end-users could not replicate efficiently on their own.

Lesson: In sectors as complex as steel and fire-sprinkler pipe, proximity to production is power and trading importers already hold that position.

—————————————————————————————————————————————————————————————————-

2. Predictable cost beats uncertain freight

Direct mill purchases may look cheaper at first, but every importer knows how quickly freight surcharges, duties, and inland costs can erode those savings.

Procurement benchmarks show that companies using structured import partnerships achieve 10–25% lower total landed cost and 30–50% less manual effort in logistics and documentation.

Trading importers simplify the equation through CIF-landed pricing, one transparent quote that covers freight, insurance, duties, and inland delivery.

For fire-sprinkler distributors quoting long-lead projects, that stability safeguards bid margins and cash flow.

Lesson: predictability protects profit. CIF pricing removes the guesswork that turns “cheap” into expensive.

—————————————————————————————————————————————————————————————————-

3. Technical compliance managed by specialists

Authorities Having Jurisdiction (AHJs) in Canada now require UL / ULC / FM certificates, ASTM / CSA specifications, and batch-matched MTRs before final approval.

Trading importers specializing in fire-sprinkler supply coordinate these documents directly with mills, ensuring each shipment arrives AHJ-ready.

Distributors and contractors gain what direct sourcing rarely provides: a fully documented, traceable product that passes inspection the first time.

Lesson: quality earns trust but documentation wins approval.

—————————————————————————————————————————————————————————————————-

4. Lead-time control through mill-slot planning

Production delays are one of the most expensive risks in the fire-sprinkler trade.

Trading importers eliminate that uncertainty by reserving mill slots 45–60 days ahead, tying each slot to a confirmed order.

Combined with consolidated container planning and pre-booked freight, this structure keeps the typical supply cycle within a 6–8-week window.

Lesson: scheduled production is the difference between predictable projects and idle crews.

—————————————————————————————————————————————————————————————————-

5. Supply resilience through multi-country networks

Tariffs, port congestion, and regional disruptions can paralyze a single-source buyer.

Trading importers manage multi-country networks, across Vietnam, India, Thailand, Indonesia, and beyond, and can pivot production routes as market conditions shift.

That flexibility is now a cornerstone of supply-chain resilience in Canada’s building and industrial sectors.

Lesson: resilience isn’t an emergency plan; it’s a sourcing design.

—————————————————————————————————————————————————————————————————-

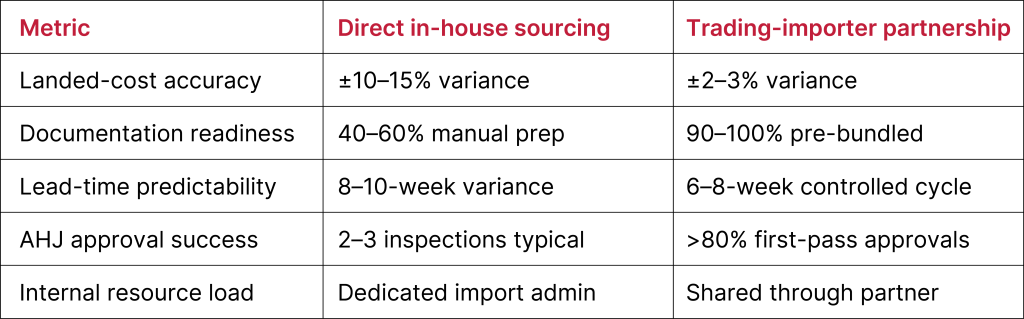

6.The measurable business impact

Sources: Deloitte Global Procurement Survey 2024, Gartner Supply Chain Insights, and public Canadian corporate disclosures.

—————————————————————————————————————————————————————————————————-

Conclusion — the new sourcing advantage

Canada’s fire-sprinkler industry is following the same path that manufacturing and construction leaders already took: replacing in-house overseas procurement with specialized trading partnerships that deliver cost control, compliance, and reliability.

From steel to retail, companies like Mitsui & Co. (Canada) have proven that global sourcing works best when managed by experts who live inside the supply chain.

For fire-sprinkler distributors and contractors, that lesson is clear. Your growth no longer depends on chasing factories. It depends on aligning with a trading importer who already has the network, the documentation discipline, and the mill access to deliver certified pipe, on time and on spec.

Because in this business, you don’t win by buying cheaper — you win by buying smarter.